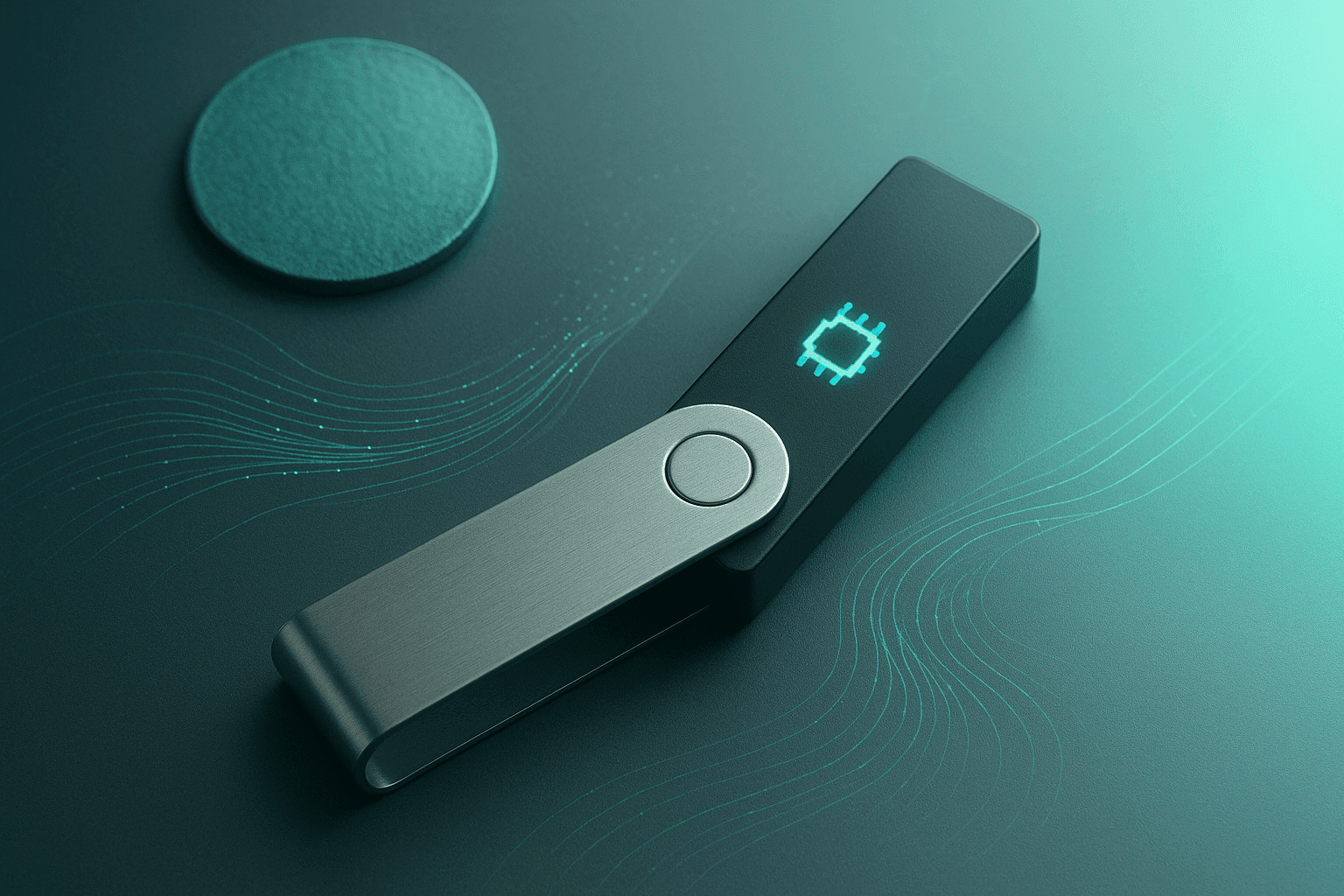

The market for cold-storage cryptocurrency wallets is experiencing significant growth, driven by increasing security concerns among crypto investors. Ledger, a prominent hardware wallet manufacturer, has reported its best year to date, with revenues reaching triple-digit millions in 2025 year-to-date.

Surge in Revenue Amid Cyber Threats

Ledger’s CEO, Pascal Gauthier, stated that the surge in revenue is a response to escalating hacking incidents targeting both individuals and companies. In the first half of 2025 alone, approximately $2.2 billion worth of cryptocurrency was stolen, surpassing the total thefts recorded in 2024. Notably, around 23 percent of these hacks were directed at individual wallets, highlighting a growing trend in personal crypto theft.

Growing Demand for Enhanced Security

- Hacking incidents have become more prevalent, particularly as cryptocurrency prices rise.

- North Korean hackers executed the largest known crypto heist, stealing $1.5 billion from Bybit.

- Industry experts indicate that unlawful activity in the crypto space is now at unprecedented levels.

Gauthier emphasized that traditional devices, such as smartphones and computers, are not designed with security as a priority. This reality has led to a growing awareness among crypto holders about the necessity of upgrading their security measures. As a result, demand for Ledger’s cold-storage wallets is expected to increase further, especially with the upcoming Black Friday and Christmas sales.

Expanding Market with New Competitors

Ledger is not alone in this market; other companies like Trezor and Tangem are also providing cold-storage wallet options. These devices allow users to store their cryptocurrencies offline, reducing the risk of theft compared to holding assets on exchanges like Coinbase or Binance. The competitive landscape is expanding, with more firms recognizing the need for secure storage solutions as digital asset holders seek safer methods to manage their investments.

Strategic Growth and Funding Initiatives

Looking ahead, Ledger is exploring fundraising opportunities, potentially through a public listing in New York or a private investment round. The company’s valuation reached $1.5 billion in 2023, following investments from key players such as 10T Holdings and True Global Ventures. Gauthier’s strategy includes increasing headcount in New York, which he identifies as a central hub for crypto investment.

Challenges for Corporate Decision Makers

For enterprise decision-makers, the rise in demand for secure crypto storage solutions presents both challenges and opportunities. Companies involved in cryptocurrency transactions must consider the security of their digital assets more seriously. The increasing prevalence of hacks and the associated financial losses could impact investment decisions and strategies within the crypto market.

Furthermore, the expansion of cold-storage wallet options may influence how enterprises manage their cryptocurrency holdings. Decision-makers should evaluate the security features of various wallets and consider integrating these solutions into their operational frameworks to safeguard against potential threats.

Increased Regulatory Scrutiny Ahead

As the cryptocurrency landscape evolves, regulatory scrutiny is likely to intensify. Regulators may impose stricter guidelines on how crypto assets are stored and secured, particularly in light of rising theft incidents. Enterprises must stay informed about regulatory developments and adapt their compliance strategies accordingly.

In conclusion, the growing demand for cold-storage crypto wallets reflects a broader trend toward enhanced security in the cryptocurrency market. As Ledger and its competitors continue to innovate, enterprises must prioritize the protection of their digital assets to navigate the complexities of an increasingly risky environment.